Trades

besomebodyfx terminal

HOW TO USE THE RETAIL DATA ON THE TERMINAL

The concept here is very simple.

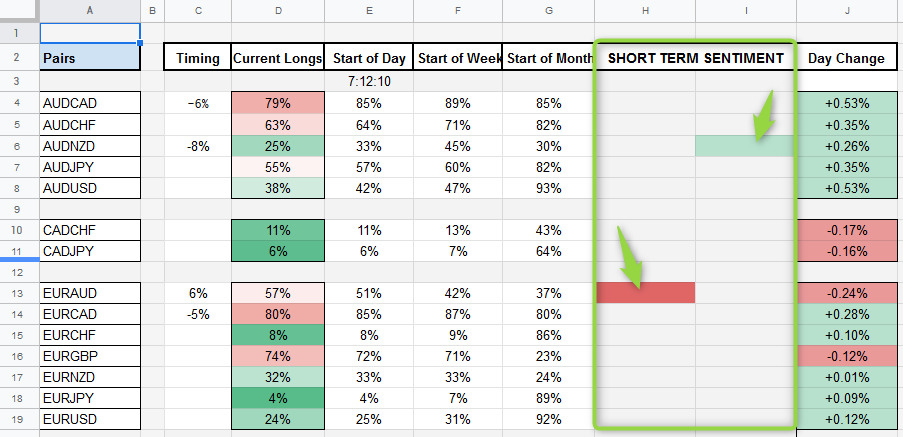

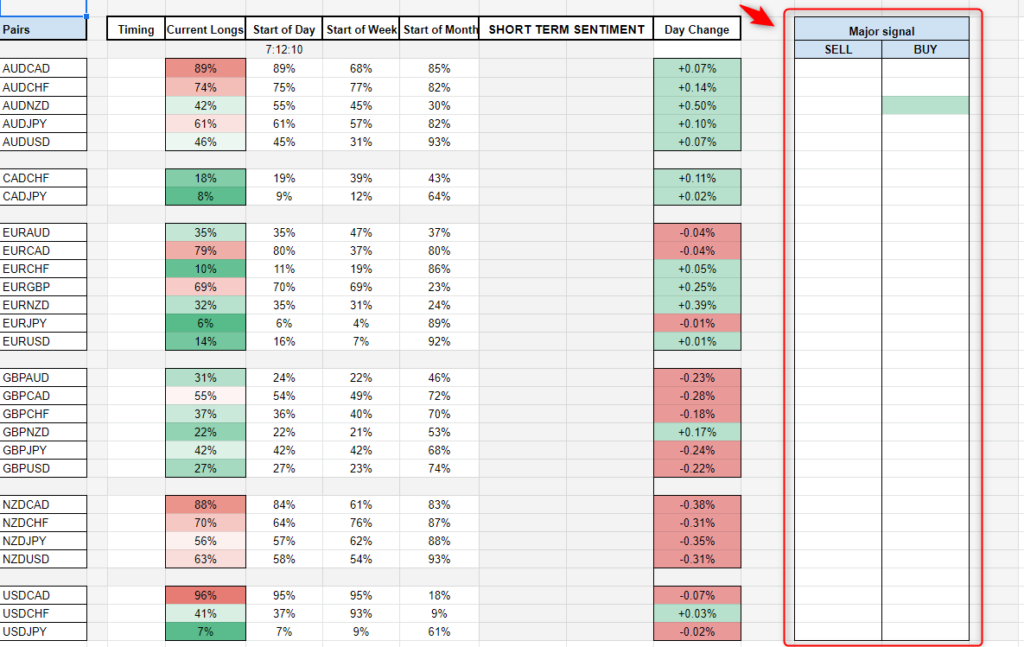

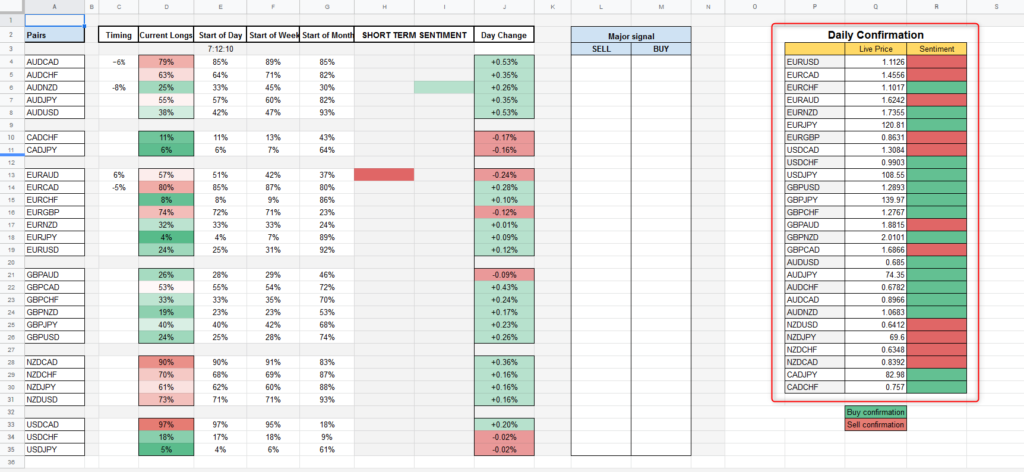

The short term sentiment signal is, as the name says, a short term sentiment momentum signal.

So it tells us to sell when retails are buying in bunch and buy when retails are selling in bunch.

Those have some very specific parameters that when triggered it signals that retail traders are piling into shorts or longs.

And yes, the signal is already set up to indicate the opposite of what retails are doing.

So if it’s red it means retails are buying and instead you want to short.

If it’s green it means retails are selling and you want to long.

But let me get into more details…

How can you trade the retail sentment?

The first way you can trade it is by opening a position accordingly to the short term momentum and catch some pips using some simple technical analysis.

Basically the short term momentum works as a contrarian to what retails are doing.

And with retails we mean the “dumb” money of the market, so once a signal is fired that means that retail traders are committing to a specific side in bunches, as a result, you ONLY want to trade against them as the markets will likely push against them.

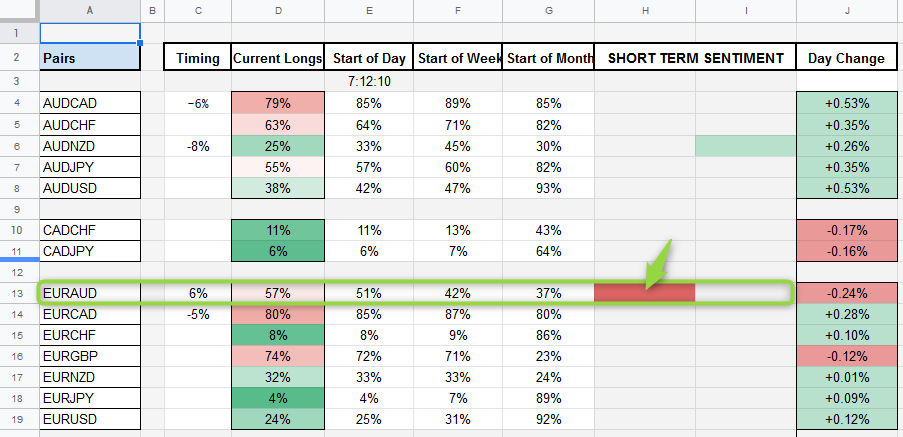

So if the short term sentiment is giving a bearish signal on EURAUD for instance, like in the example above…

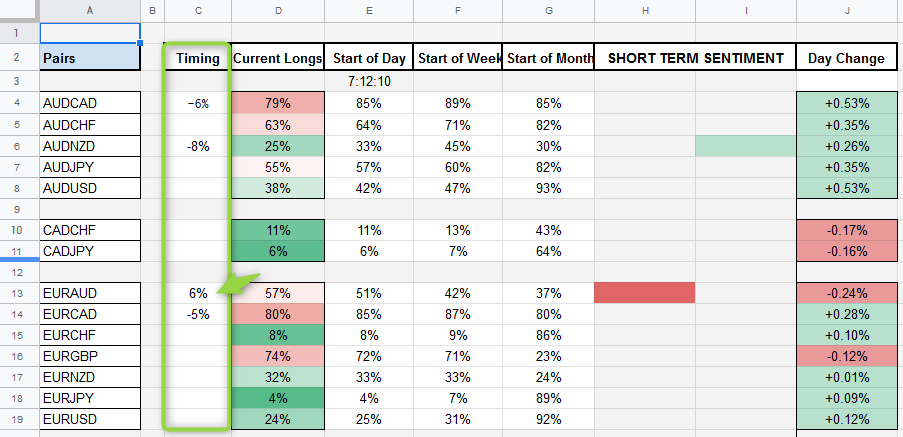

At that point you want to look at the “timing” section.

Why?

Because the timing is key.

The perfect timing is 5/-5 and 6/-6, and the closer the timing is to those values the better it is.

Let’s say, for the sake of argument, you missed the perfect timing because you were away from your desk, at sleep or at work etc…

You log in the terminal and you see a bullish momentum in EURUSD with timing at 15. Well, that’s way off from 5 and means the move more or less has already happened and most of the retails are already trapped.

And…

You DON’T want to just chase the price selling or buying at any given price.

And certainly you don’t want to get into a short term signal too late, when most of the move has already happened.

No.

So the “timing” section matters.

And in this specific example you can see EURAUD on the short signal has a timing of 6%.

That’s close enough to 5%, which means the signal is still… fresh.

Ok, now what?

Now it’s up to you to open the trade with some basic technicals.

The sentiment spreadsheet tells you where retails are getting trapped and where you should focus and in what direction you should look for a trade.

But the rest is done with the chart…

See what’s the target there?

It’s retail stops, yes.

That’s the whole point of this tool.

To see where retails are being trapped, and to then expect the market to move towards a zone of liqudity, where most retails stops are placed.

For instance…

If price is approaching a technical support…

And the sentiment is showing this…

Do you think that support level where A LOT of retails have their stops right below there is going to hold?

Unlikely…

Makes sense?

Perfect.

As you can see, it’s VERY short term type of stuff.

Once a short term momentum signal is triggered you should just want to target the very next liquidity level.

That can be just 10 to 15 pips away.

So again…

Just short term type of stuff.

After the liqudity level has been swept then the trade is done.

The medium term signals...

Alright, with the short term section cleared, let’s talk about the medium term ones…

First, what are the medium term signals?

They trigger once many multiple conditions are met.

So there aren’t many of these every week.

And they operate similarly to the short term signals, but on a more larger time horizon.

So instead of 10 to 15 pips moves these can target larger liquidity levels that can be 50 to 70 pips far.

The key here is to match this up with some of your technicals.

Don’t just follow blindly the suggestions but use your skills to catch good entries with good risk rewards.

And also, keep in mind…

There can be some false signals here so make sure you keep an eye on it once it triggers, the spreadsheet is resetted every new day so the next day the signal will disappear but it remains valid until retails current longs remain below 55 for BUY signals and above 45 for SELL signals.

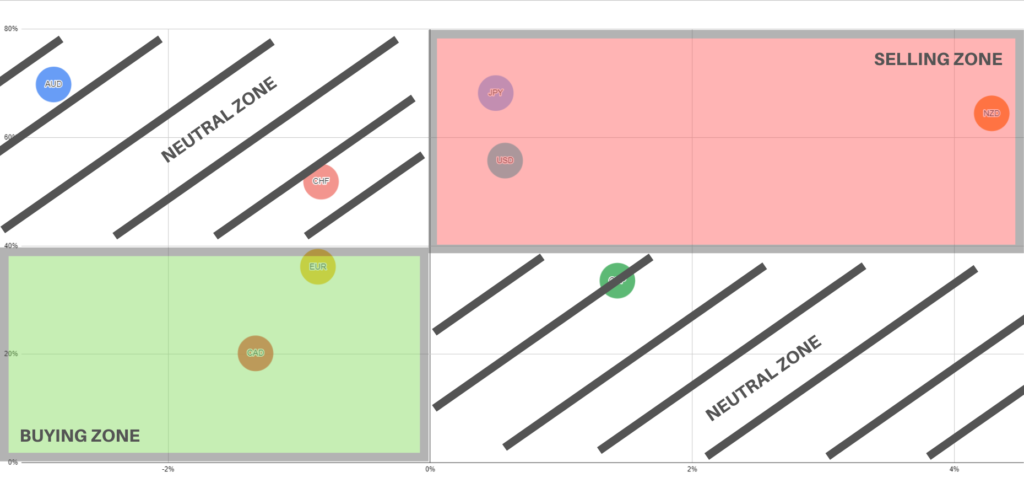

THE BUBBLE CHART...

The bubble chart is an MUST HAVE tool for intraday traders.

The use is very simple…

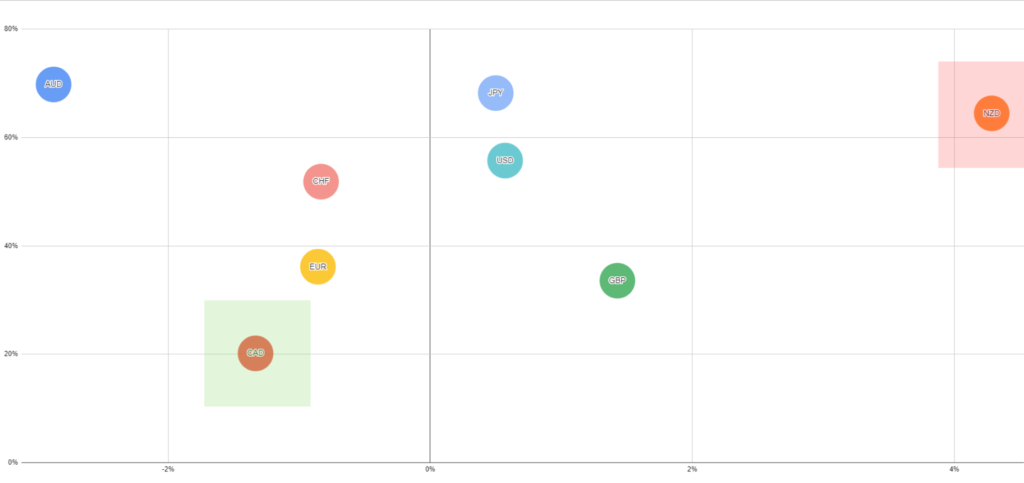

It works in 2 zones, the bottom left rectangle is the buying zone, the top right rectangle is the selling zone.

So if a currency is in the buying zone then it’s a good buy, and any currency in that zone is a good sell.

But what does it actually show?

The chart is giving you a visual representation of fresh retail action.

The further a currency is on the bottom left the more retails are selling.

And giving that we take a contrarian approach to the “dumb” money you only want to BUY that currency, at the same time the further a currency is at the top right of the chart the more retails are buying it and so we only want to SELL it.

The rest is just mixed so don’t bother with currencies in the top left zone and bottom right zone.

But so what this chart does for me?

It gives you the BEST pairs to trade every single day! So you can have that edge to make some profitable scalps.

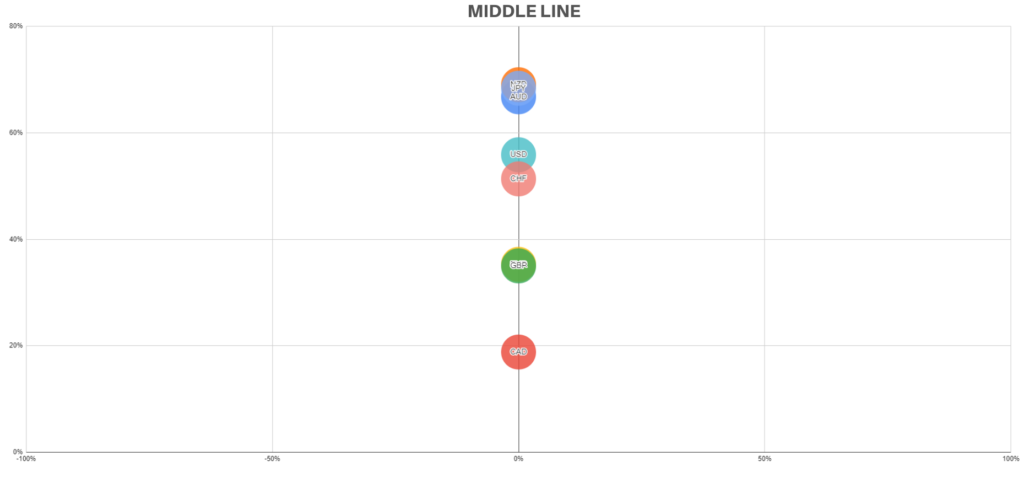

Basically the bubble chart is resetted every day before the European open, so every day you get fresh new sentiment from the chart.

So you will see how every morning before the European open the chart will reset itself to the middle line, and the currency will then start slowly moving in the buying or selling zone as the live retail positions get opened in the market.

This is a great tool to help you get fresh market sentiment visually and to get the best pair to trade and the direction to take every single day, the furthest currency in the bottom left is the best buy and the furthest currency in the top right is the best sell.

For instance, you log into the terminal and you see…

The CAD is the best BUY at the moment while NZD is the best SELL, making NZDCAD the best SELL of the market, that’s the pair you should focus on for the day, don’t get distracted by to many things, focus on 1 or 2 pairs for your intraday, that’s it.

And remember…

Always use some technicals to time the entries, this tool is just an extra confirmation to your trades.

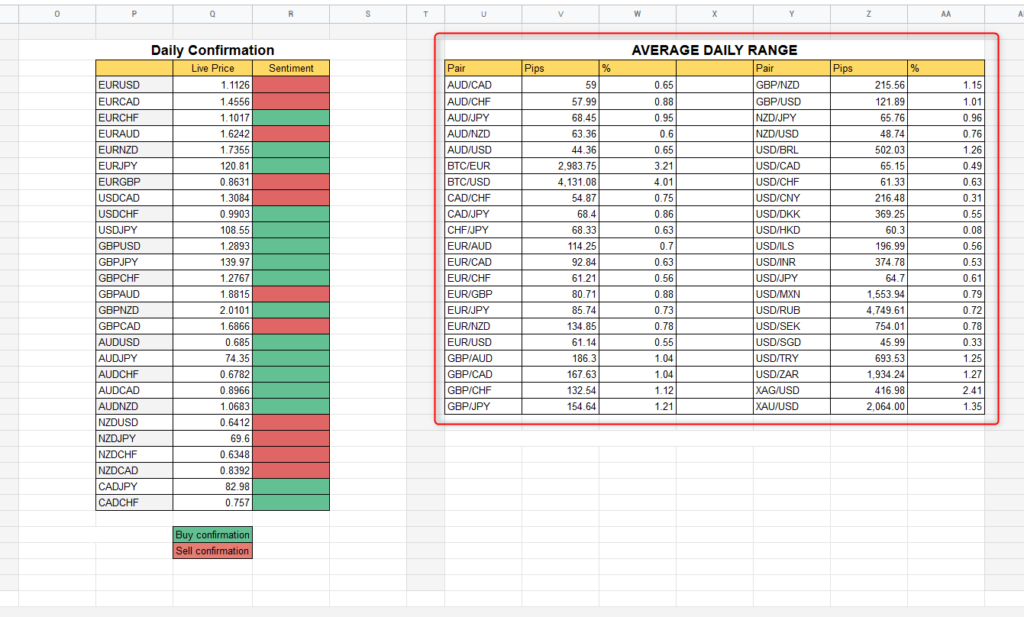

Further confirmation...

We need to get further in-depth with the intraday trading so that you can have the most edges possible for your trades, here comes the average daily range and the Daily confirmation as further confirmation.

First of all, for further confirmation you should want the Daily Confirmation to be in line with the signal and your direction…

Green is giving you the confirmation to buy when there is a bullish signal, and red gives you the confirmation to sell when there is a bearish one.

So if you get a signal to BUY you want the “sentiment semafor” to be GREEN if it’s RED you should skip the trade, and viceversa for a SELL signal you want the “sentiment semafor” to be RED.

Ok?

Alright.

The last confirmation is the average daily range.

This is useful for you to set take profits and stop losses, but it’s also very useful to see if there is more juice in the pair to move or not.

So let’s say we get a short term signal to sell EURUSD and it has a daily average of 60 pips, and price has already moved 80 pips since the beginning of the day.

That suggests you to be a little bit more careful with the trade because the pair is already beyond its daily average move.

So in that case you should want to size lower, or even avoid the trade if it doesn’t line up well enough on the chart.

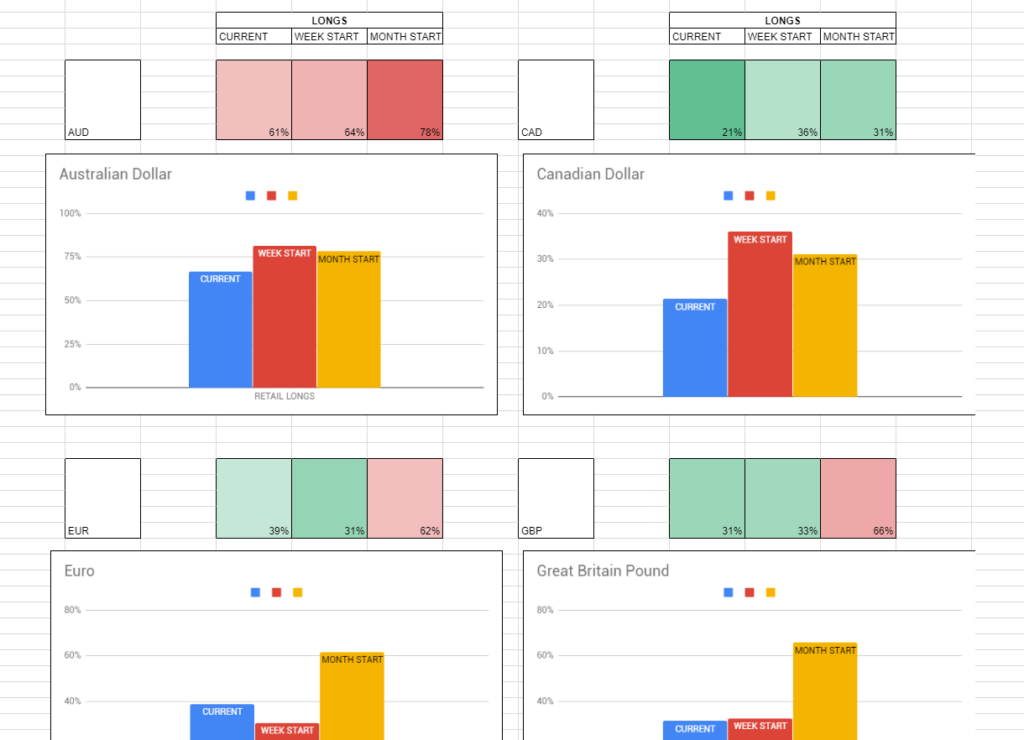

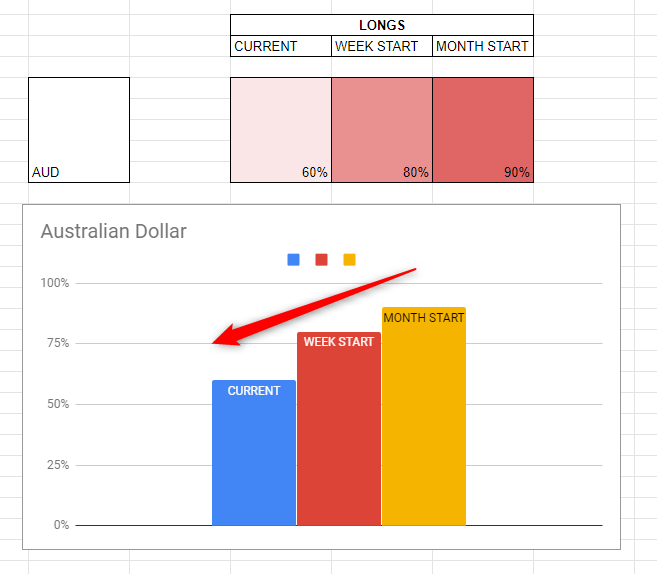

FOR THE LONG TERM TRADERS...

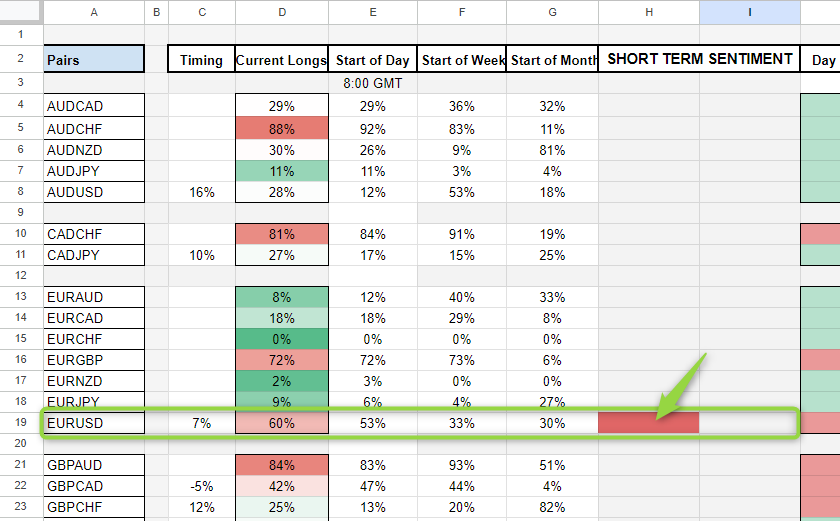

Below the bubble chart you will see some data that is more for medium-long term traders.

That data is showing behavior of retail traders during the week and the month on specific assets, what needs to be looked at here is the commitment in certain directions.

What do I mean?

I mean that we want the data to show a clean trendline showing us how retails are gradually committing into a specific direction, so that we can trade against them.

This tool is more of a “overall” outlook of what the retail traders are doing in the market, it’s interesting to use it to find currencies where they are committed to one specific side…

So for instance in the example above if retails started the month at 90% longs in AUD and the week after they are at 80% and after a few days since the beginning of they week they are at 60%, that shows us that they are closing their longs and adding to shorts.

So what we want to do? trade against them 😉

If they add to short we add to longs and viceversa.

Ok i know i know...

Your might be confused now.

But this is why we are here, by being part of the private network we will suggest you the BEST trading opportunities every time we see one.

Plus, all of these retail data will start to make sense after months of using it.

Don’t expect to start learning the retail behaviors in a few days, you will need to watch the data and the charts for a long time before you will metabolize how everything works, how retails get trapped, how and where they add positions, where they get stop hunted and more…

But with that in mind…

From now on you have no excuses, you clearly know where the retails are stuck, if you fall into the market traps again then it’s better if you close your broker account.

This tool will not only be useful for your personal trading but if you follow a signal provider for instance you can filter some of his “bad” signals by seeing if the “dumb” money are buying or selling.

And just as a side note, the average retail trader is wrong 80% of the time, this means that every now and then they will be right, so don’t expect the markets to always go against them, 20% of the time they will be right, use the other 80% at your advantage.

Please note the spreadsheet is fully automatic and does not require any input from yourself, but it’s wise to refresh the page here and there to make sure you are up to date.