Trades

besomebodyfx terminal

HOW TO USE THE MACRO INTELLIGENCE DASHBOARD

Monetary policy is one of the core drivers of market trends.

It’s NOT the only driver, but it’s a big part in our trading strategy.

In particular, monetary policy divergences:

It takes A LOT of time and effort to research what a central bank is signaling to catch these trade opportunities.

Hours of reading transcripts, watching press conferences, researching articles, and headlines.

IT’S A LOT OF WORK!

So for that reason, we’ve created an AI model that does all the research for us.

And it allows us to have a snapshot of each central bank with just a few clicks.

Now, I KNOW WHAT YOU’RE THINKINg…

Well yes! This can be easily done with, for instance, ChatGPT.

BUT THERE’S A PROBLEM WITH THAT…

I’ve OFTEN found that the various AI tools can pick up stale information, irrelevant context.

And after all, they can simply end up giving a completely wrong (or useless) view on the central bank:

Now, as you can image, getting the wrong information is a big deal when it comes to trading.

the information we get dictates out decision making:

So the more accurate our information, the better our decision making.

And the better our decision making, the better our trading.

So, here’s why this tool is not a simple chatgpt prompt:

We personally curate each analysis with our own expertise to confirm the accuracy of the information.

Nothing enters the Macro Intelligence Dashboard without us verifying it and making sure it’s legit.

in other words…

We add our expertise on top of the AI research capabilities to create the ultimate macro tool to ALWAYS have each central bank’s ACCURATE AND VERIFIED forward guidance at your fingertips in just a few clicks.

That’s a tool we personally use in our trading.

And it’s accessible here on the terminal.

Perfect, how does this work?

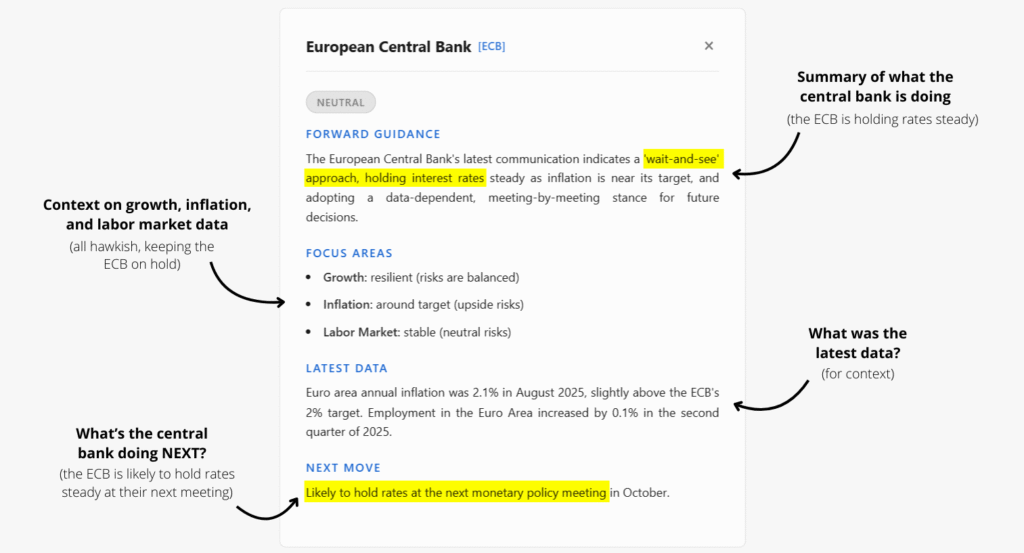

Just select a central bank, and it will open up the latest available information.

As you can see, we get the tone, so whether:

1. Hawkish (bullish for the currency)

2. Dovish (bearish for the currency)

3. Neutral (no strong bias)

And we get the relevant information that we need to make our trading decisions.

Compare central banks:

At the bottom there’s then a useful button to “compare” the research with another central bank:

ANALYZE EACH HEADLINE:

Or, if we want to dive deeper into the analysis we can open up all the relevant headlines for that central bank, to see what their recent comments were.

Like this:

That’s how it works, simple and intuitive.

And now here’s where it gets interesting!

A real example:

Ok, theory is great.

But let’s see this thing fly.

Let’s run a real world scenario.

First, we look at what the European Central Bank is doing:

Ok, Slightly hawkish with the ECB looking to keep rates steady.

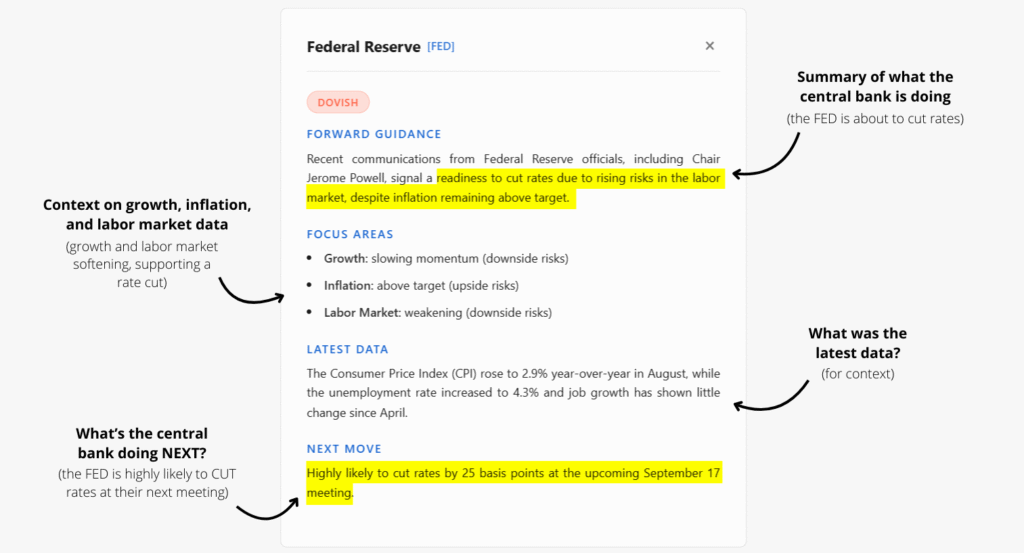

Now, we do the same for the Federal Reserve:

Oh, ok!

That’s dovish.

It’s not a perfect divergence.

But there’s still a noticeable difference in tone there.

1. One is looking to cut rates soon (the Federal Reserve)

2. And the other (the European Central Bank) is not

Perfect!

We have the WHY, we have the fundamental bias.

EURUSD is likely to trend higher.

Now what?!

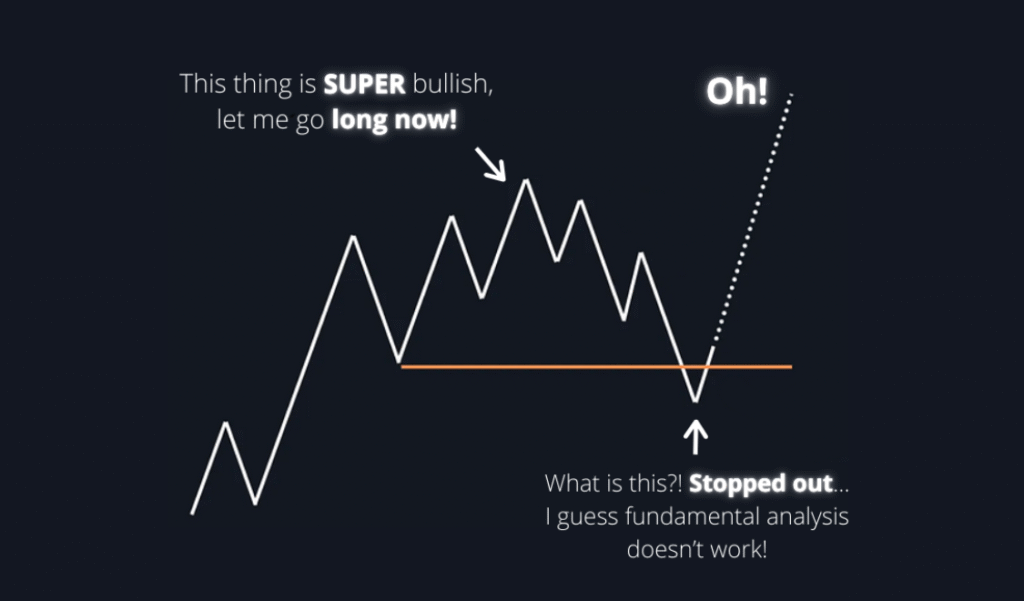

Do we go and buy EURUSD right away?

No.

We don’t just slam trades because this tool says “hawkish” or “dovish”.

The fundamental context gives us the direction in which the market is most likely going to trend to.

It’s the WHY.

The directional bias.

But then we still need the WHEN.

The… when to act on that trade.

IN OTHER WORDS…

Fundamentals for direction, technicals for entry.

It’s important to match the two, because otherwise:

Makes sense?

Perfect!

So once we have a macro bias, it’s time to time the entry with technical analysis.

THE NEXT STEP…

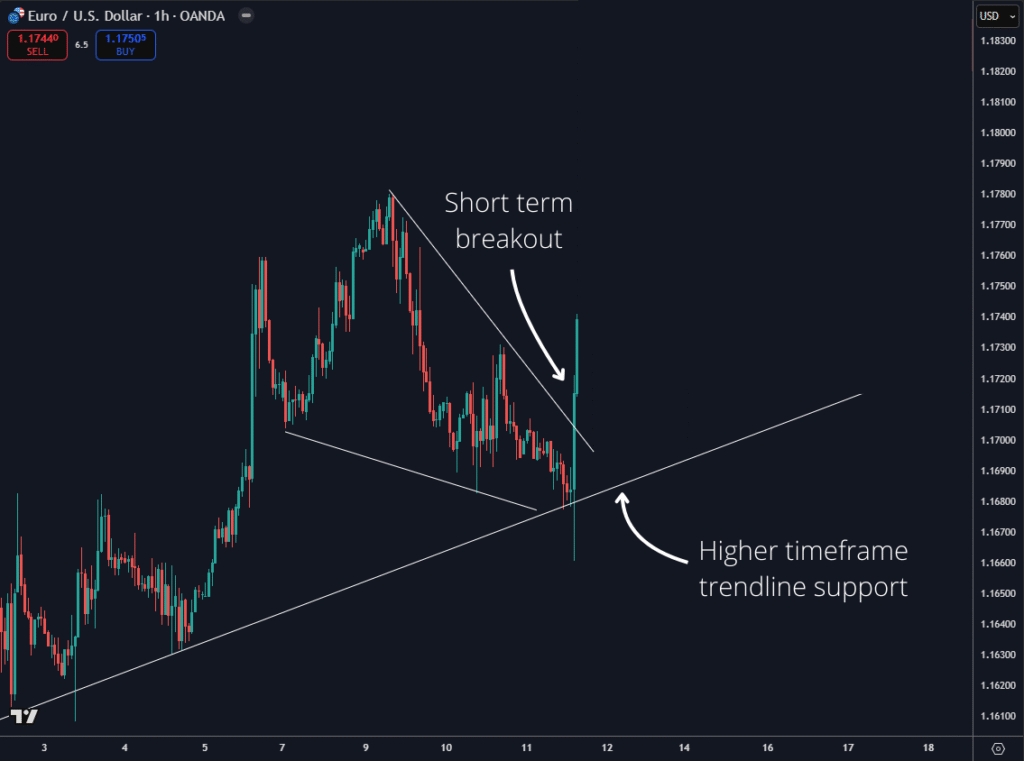

We open the EURUSD chart and we see this:

There you go, we have confluence now.

Notice that clean technical structure being breached.

And perfectly from higher timeframe support.

It’s a bullish signal from the chart, and we listen to that.

So what did we do?

We went long EURUSD in the Private Network.

It’s a calculated, evidence based idea.

That leads to a profitable trade:

That is how it works.

NOW REMEMBER…

This tool is powerful.

But like any professional tool, it has rules.

If you don’t follow then, you’ll get chopped out.

RULE 1:

Never trade just the monetary policy sentiment.

Always confirm and time the trade with technicals.

RULE 2:

Divergence is a process, not a short term event.

Give the story time to unfold, don’t expect the market to move in a straight line, policy divergence trades are medium to long term trades.

So take that into account.

AND THAT’S ALL..

A perfect tool to always be up to date with what central banks are doing, thinking, and projecting.

Then we, as traders, decide how that plugs into the bigger narrative for our trades.