Trades

besomebodyfx terminal

HOW TO USE THE SMART MONEY INDEX

Alright so let’s see how the Smart Money Index is used…

It’s very simply, but first let’s start with what this tools is for:

This system spots anomalies in the daily short sale volume across various S&P500 stocks…

Why short volume?

There is a middleman (market maker) for just about every order that is executed on the market. Lucky for us, this middleman always leaves a trail, he is forced to sell short whenever he fills a buy order.

Whenever a market maker fills an investor’s buy order, the

MM is facilitating the trade by SHORTING shares. Thus, short volume is actually representative of investor buying volume…

And this is why short volume is a strong indicator of buying activity in our case.

Where we take the daily short sale volume data?

https://www.finra.org/filing-reporting/trf/trf-regulation-sho-2018

http://regsho.finra.org/regsho-Index.html

You might be more confused than before here but let’s get to how the tool works and how we use it for building positions in the S&P500.

With the daily short sale volume data we build this index that we call “smart money index” just because these money have been buying perfectly with very small drawdown every major correction in the S&P500 so they must be smart no? 🤪

We then track the anomalies in this index which is illustrated by a value printed above 0.48x… updated to 0.53x in 2023 to fit new volumes standards.

When that value appears that means there is strong short sale volume which means…?

Which means that the market makers are selling high quantities of market shares to these “smart money”.

But enough of this and let’s exactly how we use this tool:

As already noted above the concept is extremely simple, when we get a print above 0.53x we buy the S&P500 and hold for 3 months straight…

The examples below are from when the model was set at 0.48x, but again… now it’s 0.53x, either way… when the number turns green, that’s the trigger.

As you can see we colour in green the cells that printed a number above 0.48x so that we can find them easier.

And before you say it… no it doesn’t reprint or overfit, once a day is closed and a value is printed that’s it, no going back…

Trust me it’s very simple, bear with me a second, this is historical data for the sake of the example:

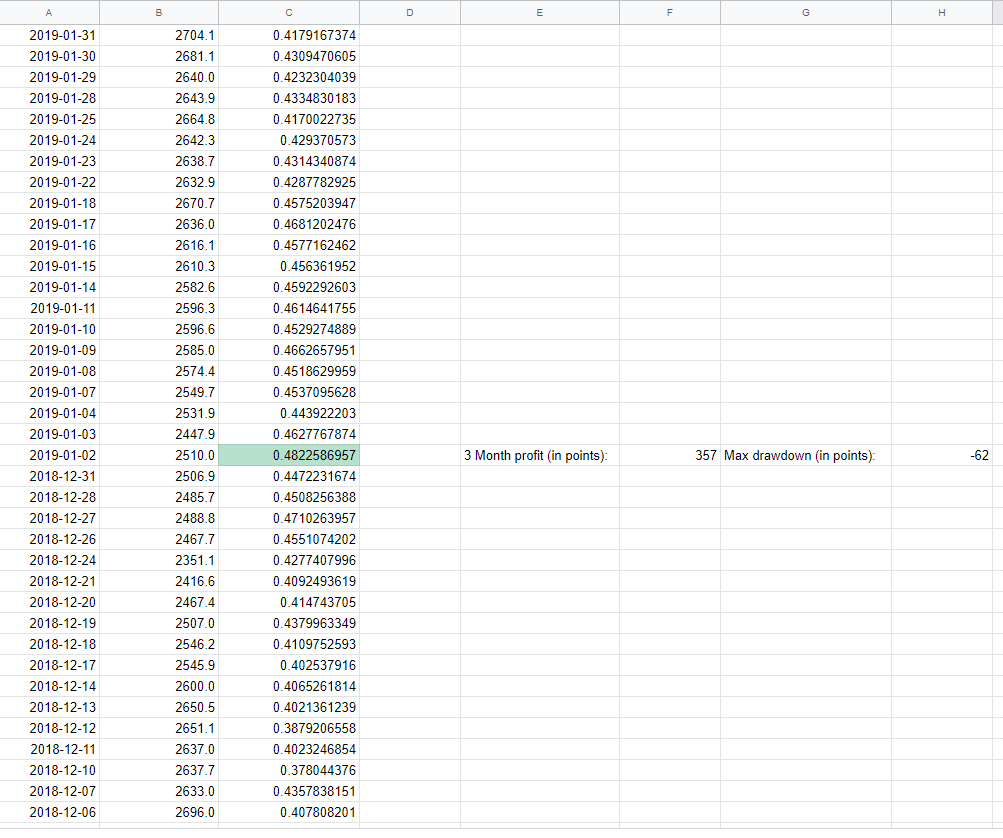

On column A of the sheet you will find the date, on column B you will find the S&P500 daily closure so the price at which the S&P500 closed on that specific date and last but not least the Smart Money Index value in column C.

So let’s take a look at what’s happening in the image above, if you take a look at the first value at the bottom it’s December 6th 2018 (2018/12/6) and the S&P500 is trading at 2696, going ahead a few days and we see that the S&P500 is trading lower and lower everyday so it’s more or less in a bearish trend so when it’s time to finally buy the dip safely?

Well that’s the Smart Money Index job… The volume anomaly appears when the index is above 0.48x, so as soon as we get that print we open a buy position and hold for 3 months straight…

Why 3 months?

So technically here we could be holding forever, no joke! Here we could be just buy the dip when the index says to and hold until we are satisfied with the profits or just trail stop loss higher and higher (when the S&P500 starts to trend after a crash you don’t stop it easily), then usually more signals are generated while the market goes up hence more positions are opened and profits compounded…

BUT for the sake of the strategy we picked a timeframe to hold the position and then sellback so we picked 3 months because that’s the average duration of a prop trader portfolio.

Back to the example, the S&P500 is “crashing” (as the perma bears would say) until we finally get a print in the index above 0.48x in January 2nd 2019, so we open our buy and hold for three month straight and well yes that was basically the bottom, we encountered a small drawdown of 62 points but closed the trade in 357 points of profit.

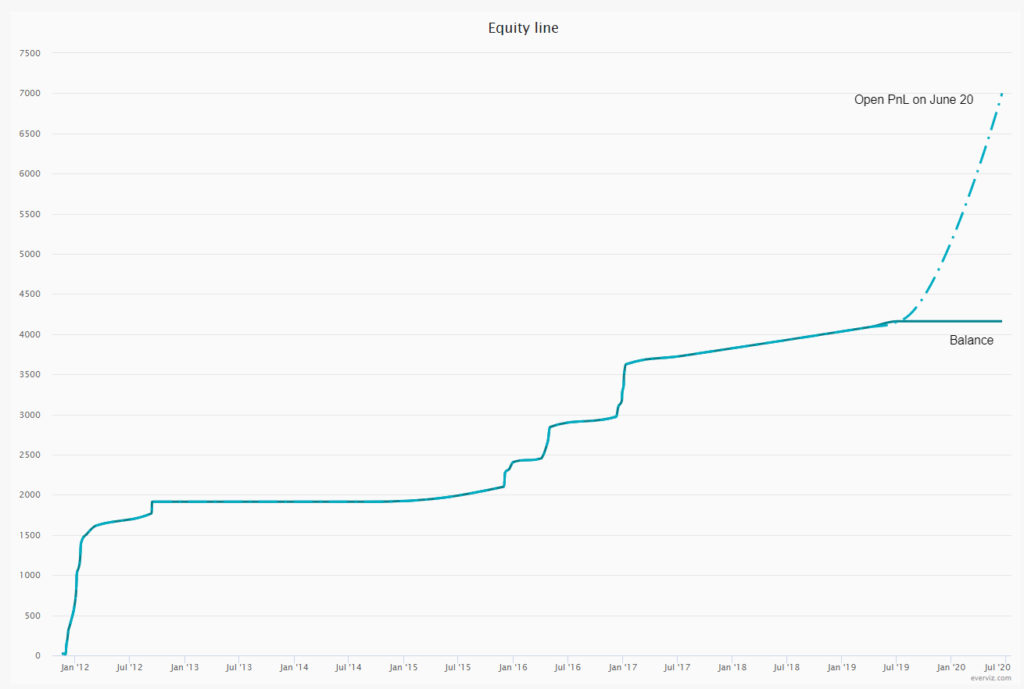

Here is the visual representation:

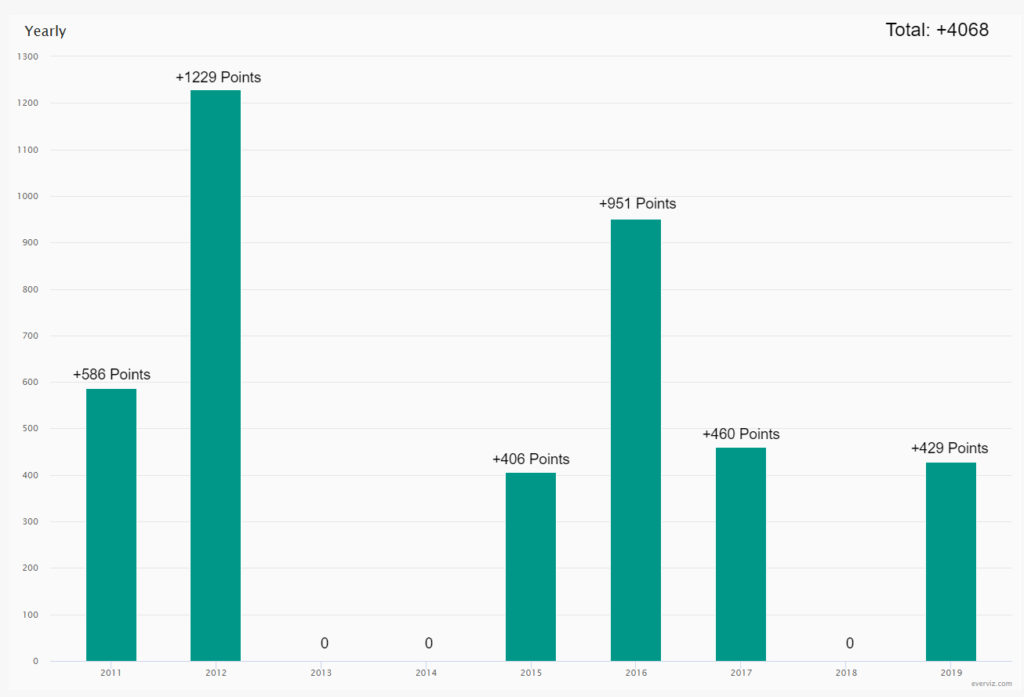

Now let’s see some clear stats…

Yes there hasn’t been any trade in 2013, in 2014 and in 2018, why?

Because we didn’t have enough of a correction to trigger a buy signal so no position was opened.

For some this may be a bummer but hey this is an extra tool that you add on your portfolio of trades so it’s extra performance added to what you already perform with regular trading, this system didn’t generate trades in those years but we have other ways of profiting from the market too, plus don’t forget it’s an extremely “stress free” and effective system, just open the position and cash it after 3 months, don’t forget the value of the profits are relative to the amount of work you put into a position…

It’s more valuable a 40% a year made with just a few hours of work every month/week or a 100% a year made with 8 hours of work everyday?

I will take both because i’m a market junkie 🤪 but yeah you get the point…

On total 37 trades for a total of 4068 points so far, without taking into considerations the trades opened in the 2020 recent correction where the tool predicted the bottom with just 100 points of drawdown (may seem a lot but it’s nothing in 2020 crash volatility) and those positions are floating well in profit now…

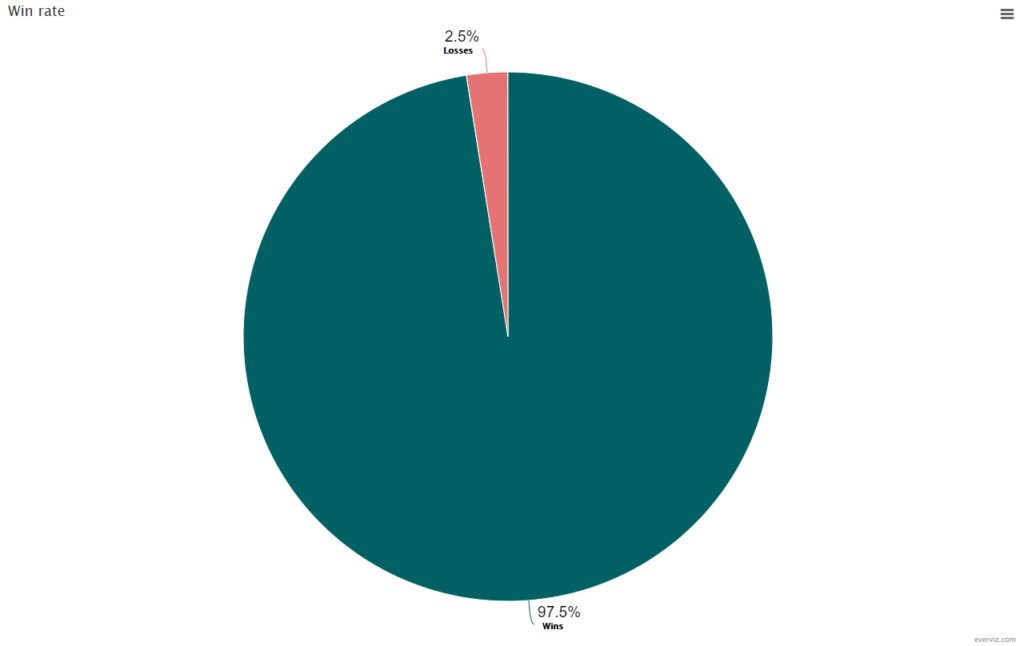

Win rate? 36 winning trades and only 1 losing… (a mere -15 points)

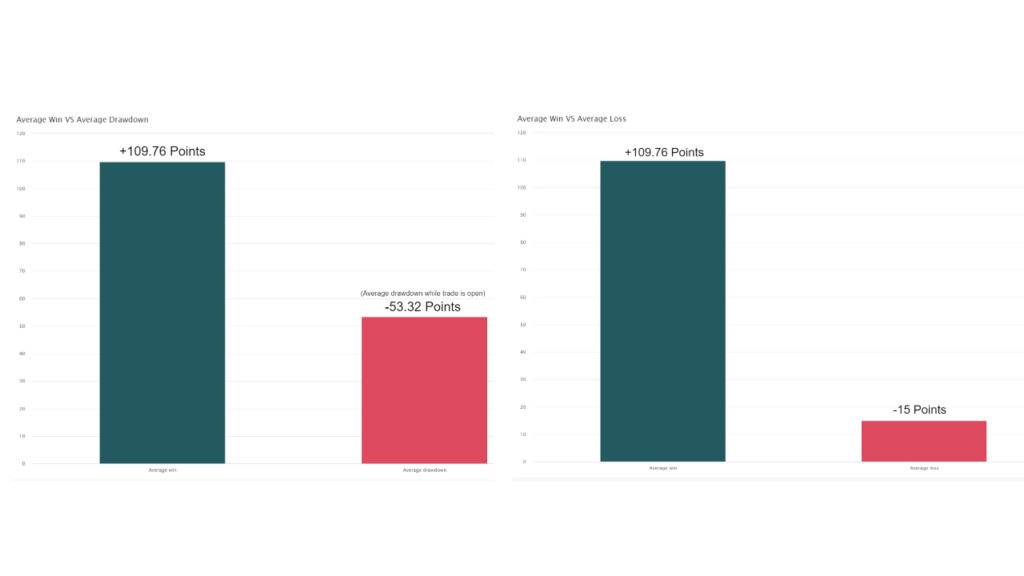

Average win is 6 times more than the average loss (which is only one) and for us it’s very important the drawdown during a trade which on average is around -50 points which is half than the average win, those are some great stats…

So do we have a winnings system here?

As much as i would love to say YES, we can’t ever say that for certain as past performance is NEVER indicative of future results, but hey… we have something that has proven to work over the past 11 years with great risk reward and stats which give us a high chance of more profitable years ahead, and most of all it’s extremely effective to use and “stress free”, wait for the signal, deploy your position and wait 3 months to cash your profits, what else you want? I would pay gold for such a system…

Ah don’t worry you don’t need to opt in the terminal everyday to check where the index is at, we will of course notify you on Telegram every time we get a print above 0.53x

Enjoy